[YAN] Indian Trading Landscape and The Big Four

Yet Another Newsletter | Issue 10

Follow me on Twitter for announcements and startup rambles

Back Cloud Capital Syndicate for early-stage investment opportunities

Subscribe to Yet Another Newsletter and spread the word :)

This week’s jazz:

Glimpse into the Indian trading scene

How ‘big’ is the Big Four?

Indian Trading Scene:

“The Nifty is approximately 1.4 percent short of a lifetime high” (MoneyControl), headlines like these + ‘work from home’ have triggered many to sign up on trading platforms, open their Demat accounts, and invest in the public markets. Over the past few months, we came across fascinating stories about the massive influx of young and novice traders on Robinhood and their infamous rallying of stocks of bankrupt companies such as Hertz. I was quite surprised to find a similar yet not so careless piquing curiosity within the Indian population as well as new-age digital trading platforms such as Zerodha, Groww, etc gain quite the traction.

“60-70% of new customers that are onboarding with us over the last few months are first-time investors with no history of trading” - Nithin Kamath (CEO, Zerodha)

The trading landscape:

~ 40 million active Demat accounts in India

Only 2-3% of India's population invests in the stock market vs US/EU markets where penetration is 25-40%

vs 200 million people with fixed deposits in India

Historically, the number of individual investors has been increasing at a 10-year CAGR of 11% (ET)

As more of India’s young workforce gets ushered into simple and all-digital personalized financial engineering through new-age startups such as Groww, Upstox, etc, I am curious whether we would be able to expect a tidal rise of more capital floating into the Indian public market?

Geographic split for online trading platforms:

Groww: 60% of clients are from non-metro

Upstox: 80% of clients are from tier II and III

Angel Broking: 60% of clients are from tier III

vs Zerodha where the majority of their clients are from Mumbai, Pune, BLR, Delhi, and Chennai

Age Group

Median age group for Groww, Upstox, and Zerodha: 28-30

65% of equity investors on Paytm Money are below the age of 30

Equally amazed to learn that Zerodha currently processes transactions worth $10 billion on its platform, accounting for 15% of the overall industry turnover! That’s mighty impressive for a bootstrapped player in the ecosystem. As someone who has recently started investing via Zerodha, my initial impressions are that of a bedazzled novice - looking to play around more with what it has to offer.

How big is the Big Four?

The enigma of what we know as The Big Four has drawn the attention of many for years. The Big Four are, literally, the four largest professional services networks in the comprising of Deloitte, Ernst Young, PricewaterCoopers, and Klynveld Peat Marwick Goerdeler a.k.a KPMG.

Big Four wasn't always just the Four but originally started off as the Big Eight around the 1980s and since then has been through multiple consolidations.

I am not ashamed to admit that I purely regarded the majority of the Big Four as glorified accountants; apologies for my ignorance but they do own 75.66% of the total accounting market share in the world. A couple of other facts that caught me off-guard about these four firms:

$154 billion in total revenue (2019)

495 out of 500 of S&P 500 index companies were audited by one of the Big Four in 2019

100% of the FTSE 100 index are audited by one of the Big Four in 2018

Total employees > 1 million

Services offered other than auditing: Management consulting, Taxation, Legal Advisory, Market Research

Only 20% of Big Four's total revenue in UK was from 'accounting'

As of 2017, Big Four has captured 40% of the consulting market

The collective impact of the Four globally is undeniably impressive. Of course, with great power comes great responsibility, and turns out that these prestigious companies have stumbled into reputational taints in the past with ginormous scandals such as Enron and countless others. In case you’re interested in the most recent UK audit scandal then feel free to dive in here.

"I still hate Ernst & Young.” (Ben Horowitz, The Hard Things About Hard Thing). This quote still gets me cracked up. Disclaimer: I am taking this quote completely out of context and you should probably read the book to understand why.

Moving on ... how effective is the 'audit' you ask?

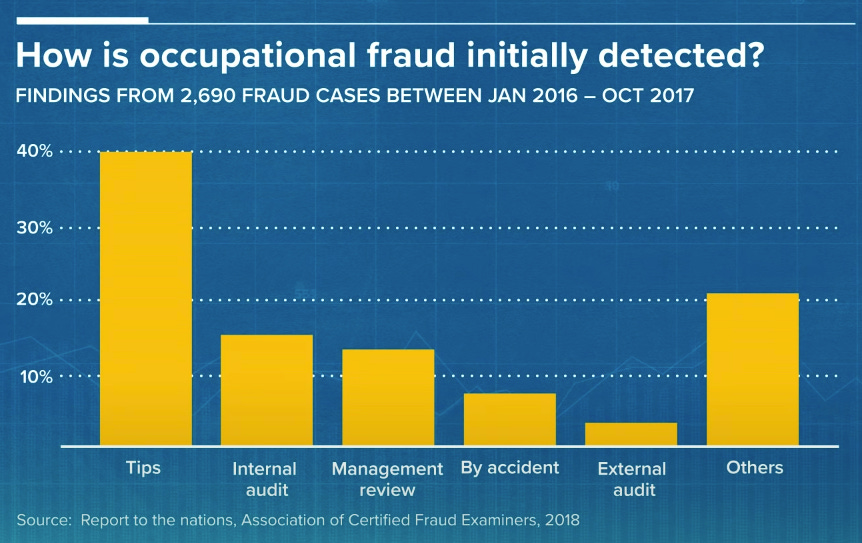

If tips, internal audits, and management reviews account for ~65% of fraud detection, it's probably worth gauging the ROI of external audits. More than anything, I am curious to learn, what startups are going after the Big Four? Seems to be that this market is primed for disruption in some shape or form, probably is with subtle enterprise-grade technology being leveraged for a very focussed use-case.

Moving on to another use-case that falls into our area of interest, how much do the Big Four earn from the IPO market? Crunchbase recently came up with a great piece on the topic that you can find here.

“law firm fees are somewhere around $1.7 million to $2 million for this type of transaction (costs to go public), and auditor fees are also around $2 million” - Crunchbase

Interestingly, it’s quite the recurring source of revenue for the auditors as the incremental costs aren’t anywhere close to being negligible: